Recently, many dairy producers have seen their revenues decline as a result of mandatory deductions from processing plants. While no one likes a smaller milk check, dairy risk managers who want to protect their profitability will need to account for these deductions as they calculate their forward margins and consider adjusting existing margin management strategies to account for the impact of the deductions.

Balancing Milk Supply

Processing plants balance changes in supply of milk against processing capacity and seasonal demand for end products. Spring flush brings more milk to plants, but plants compensate with longer operating hours or agreements with milk handlers to make sure all milk is processed. But demand for dairy products is seasonal and does not always coincide with spring flush. As school season begins in the fall, fluid milk processors increase production, which pulls milk away from butter/powder plants. But even on a daily basis, regardless of season or supply of milk, plants will buy/sell spot loads to either fill an existing order or reduce excess supply. This is part of the business. But what happens when all processors in a region are at capacity and unable to handle the milk supply? Plants with excess supply are forced to either dump milk or haul it long distances to find a home. Either way, they face additional costs, which are then passed on to cooperative members through deductions to their milk checks, often labeled as “balancing plant costs.”

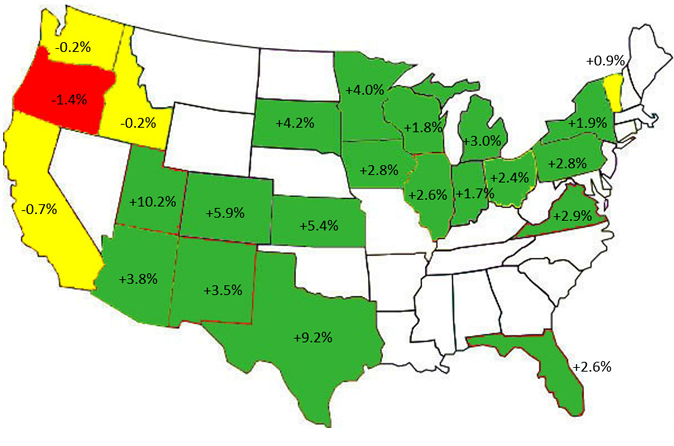

While national year-over-year milk production has been increasing steadily since this past spring, the growth has been uneven; significant growth in the Southwest, Upper Midwest and Mideast Marketing Orders has been offset by lower milk production in California and the Pacific Northwest (See Figure 1).

Figure 1: Year-Over-Year Change in U.S. Milk Production by State

For example, in Michigan, a 3% annual growth rate in milk production has not been matched by a commensurate expansion in processing capacity, leading excess supply to be sold out of state and at discounted prices. This has put pressure on milk handlers in surrounding states. Members of cooperatives in this area pay for this through deductions in their milk checks, often labeled as “balancing plant costs.” This year alone farmers in areas effected by surplus milk have reported deductions up to $1.90/cwt from their milk checks.

By contrast, as a result of lower production, California processing plants have been short on milk. This has led some coops and proprietary plants to add quality and yield premiums to the price they pay to entice higher production.

Take Deductions, Add Uncertainty

Just as milk supply and demand has varied from region to region, deduction amounts, durations and even communication with producers has varied from plant to plant. Some deductions were a one-time event, while others are ongoing. Some producers received advance notification about deductions from the plants. Some may also have some visibility into how big the deductions will be and for how long they will continue. But some producers learned the bad news when they received their final monthly milk statements and have no idea what to expect going forward. What also may be frustrating for dairy producers is that these deductions are taken after the uniform blend price has been calculated, making them a variable risk to profit margins that can’t be effectively managed or controlled.

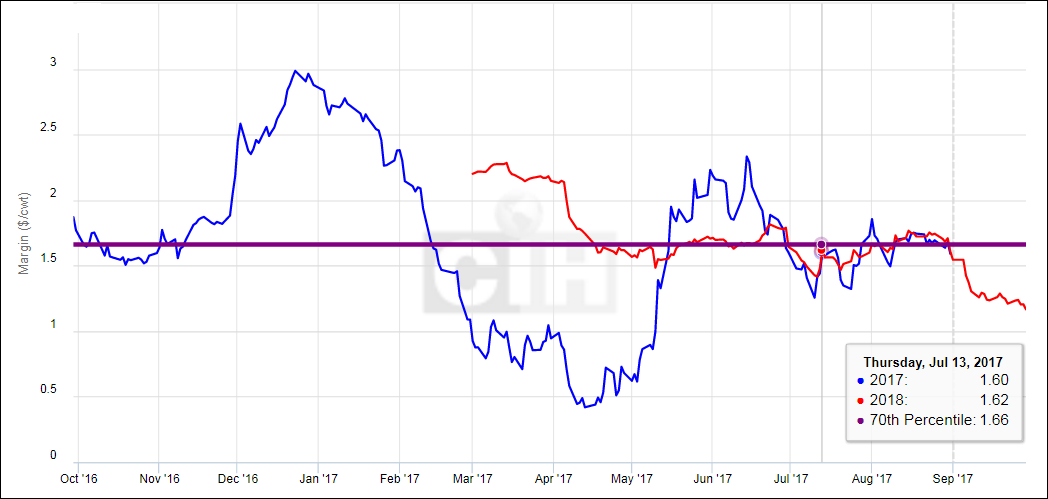

While dairy margins have been generally positive for producers thus far this year, they have not been overly strong, even excluding the deductions. For example, over this past summer, Q3 margins for a typical dairy operation in the Upper Midwest ranged between $1.25 and $2.25/cwt., which would be at about the 70th percentile of the past 10 years (see Figure 2). When you then account for the possible deductions, some dairies could have seen their third-quarter profitability wiped out, and in some cases, depending on how the dairy had hedged, they could even have recorded margins that were negative for a given month.

Figure 2: Historical vs. 2018-Projected Dairy Margins

Factor in Deductions, Consider Strategy Adjustments

For dairy producers facing these mandatory deductions from their milk plants, there are important risk management considerations that need to be addressed. First, to the extent that the plant has provided forward visibility on how large future deductions will be and how long they may last, it is imperative to factor these deductions into forward margin calculations. As an example, if I am an Upper Midwest producer currently projecting a Q4 average margin of around $0.90/cwt. and I have been informed by my co-operative to expect a $1.00/cwt. deduction from my final October milk check, I am now actually below my breakeven by 10 cents.

Next, I want to consider how these adjusted margin calculations impact the current risk management strategies I have in place to protect my forward margins. Let’s assume for instance that I am short Class III Milk futures, and this hedge is part of my $0.90/cwt. margin calculation. As a result of the mandatory deduction in my milk check, I am now looking at a loss of $0.10/cwt. Given that projection, I may want to adjust my hedge by closing out the short futures contract and replacing it with a long put option so that I can participate in higher prices and a positive margin should the milk market continue to recover through the fall.

Another consideration would be whether or not any call options had been previously sold and at what strike price. This position may have been taken to help reduce the cost of a hedging strategy to establish a floor price under their milk by purchasing put options. It would be important to know the net price of the strategy, including the cost of the puts. If this maximum price is now effectively below breakeven for that month or quarter after the deduction is calculated, a producer using this strategy may want to buy those call options back and close out that part of the position – particularly if the call options have decayed and are worth less than what they were initially sold for.

In addition to existing price hedges, this same approach would also apply to new positions in deferred periods. As an example, a producer contemplating their Q1 risk management plan might not know whether current deductions being taken by the plant may continue into 2018. As a result, added flexibility would be desirable to protect their milk price and allow for the possibility that higher prices could lead to improved margins. Here too, option strategies might be favored until the producer has greater visibility over the continuation of potential balancing plant deductions on their future milk checks. While these deductions are not something that producers can control or hedge against, it is possible to tailor existing or new price hedges to account for the impact these deductions will have on forward profit margins.

If you’d like more information about how you can maintain the flexibility you need to navigate an increasingly uncertain dairy margin landscape, please call us at 1.866.299.9333.