As 2019 closes out, hog producers are no doubt feeling better about the upcoming year compared to what is being left behind. To say this year was tumultuous for the industry is putting it mildly. Months of uncertainty with escalating confrontation between the U.S. and China has given way to a first phase trade agreement that could lead to significant increases in pork shipments among other agricultural commodities. Meanwhile, ratification of the USMCA will restore favorable tariff treatment for U.S. trade across the borders and likewise be beneficial for U.S. pork demand. Furthermore, the new year will also usher in a return to preferential tariffs for agricultural exports to Japan where the U.S. lost ground to competitors after withdrawing from the TPP. It has been said that the confrontation with China in particular has curtailed the ability of the U.S. to supply the country with a reliable and affordable supply of high quality pork as the nation has seen its own domestic swine herd devastated by ASF over the past year and a half. While their demand for pork from all origins including the U.S. will certainly help to support prices in the upcoming year, it is also important to keep in mind the supply situation and its impact on price.

In the December WASDE report, USDA updated their projection for 2019 U.S. pork production to 27.708 billion pounds, up 74 million from the November estimate of 27.634 billion, and 406 million above their estimate back in June as hog and pork supplies in the second half of the year came in well above expectations. The current projection for 2020 U.S. pork production is 28.694 billion pounds, an increase of 3.6% over the current year and roughly in line with both the percentage increase in the Dec 1 all Hogs & Pigs inventory year-over-year as well as the Sep-Nov pigs/litter from the latest quarterly inventory report at 103.02% and 103.07%, respectively. The percentage increase year-over-year in the heaviest weight hog categories continues to be larger than what would have been expected based on previous surveys, and this is something that market participants will continue tracking in the new year as we move into 2020.

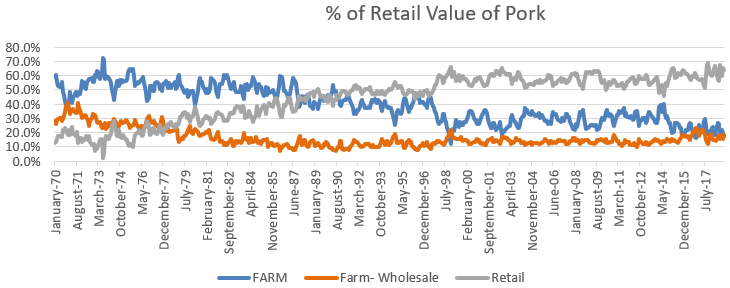

This brings up an important point. While the demand for pork is obviously quite strong, pork demand and hog demand are not the same thing. At the end of the day, producers’ revenue and profit margin are ultimately determined by the price of hogs they are delivering. While this is obviously correlated to pork value, it is important to remember that they are different. Figure 1 shows the retail value of pork broken down by component going back to 1970. These include the farm, wholesale and retail shares of the total price. What you will notice is that the retail value or share now makes up a majority of the total retail pork price at around 60%, with both the farm and wholesale values comprising about another 20% each of the total pork value. Another thing you will notice is that the retail value or share of the total price has gradually been increasing over time with the wholesale and especially the farm value shares declining since 1970.

Source: USDA Economic Research Service (https://www.ers.usda.gov/data-products/meat-price-spreads/)

Another way of thinking about this is that over time, the retailer has taken a larger share of the total pork dollar, with both the packers/processors and producers losing ground. There are a couple inflection points on the chart including 1998 and 2015 where the farm share lost ground relative to the preceding periods. These both corresponded to supply-side market shocks, although for different reasons as the former period concerned inadequate processing capacity relative to the market supply of hogs while the latter related to production losses resulting from PEDv. There has been much focus over the past few years on the strength in pork cutout value relative to negotiated cash hog prices. There is perhaps also a sense that much of the vertical integration we are now seeing in the industry may be in part a result of increasing retailer leverage.

The supply side of the market will definitely be a big influence over price in the coming year, even though the focus will obviously be on demand. In terms of demand, USDA is currently forecasting a 12.8% increase in exports for the coming year, with 804 million pounds of additional pork being shipped during 2020 compared to 2019. This forecast was also made with the assumption that existing tariffs would remain in place. Given expectations for China to remove tariffs on U.S. pork, some estimates are now as high as a 1.5 billion pound increase in exports, and that will likely be needed if prices are going to move significantly higher in the new year.

Even with the 800 million pound increase to projected 2020 exports, total pork use per capita is forecast essentially the same next year at 52.6 pounds versus 52.7 in 2019. Looking at the bigger picture of total red meat, and especially red meat together with poultry, per capita use in 2020 is projected at 225.6 pounds compared to 224.2 in 2019 and 219.5 in 2018. Given expectations for a dramatic expansion in the broiler industry, there will be no shortage of protein to consume in the domestic market. As a result, hog producers better hope that peace prevails on the trade front in the coming year. Anything indicative of either larger hog supplies and pork production, or lower export demand will not factor favorably on the price outlook as the domestic market will already be saturated with inventory. The economic landscape will also be important moving through 2020. Domestic demand has no doubt been aided by continued growth and historically low unemployment while inflation has held in check. While this outlook is forecast to continue for the foreseeable future, any signs of recession given the late stage of the business cycle would likewise not bode well for the market.

In terms of strategy, hog producer margins continue to look favorable into 2020, with positive returns projected through Q3 between the 75th and 87th percentiles of historical profitability over the past decade. While Q4 margins are not as strong, they are close to breakeven which is better than where spot margins for this current year’s quarter are finishing out. With the price recovery we have seen over the past month in the hog market, option implied volatility has come down although it remains very high from a historical perspective.

Perceived risk is still quite large in both directions, so producers need to weigh their comfort level to this potential exposure as they consider hedge strategies. As an example, if ASF were to arrive in the U.S. and close off our export market, are you comfortable with the degree of protection you would have to significantly lower prices? On the other hand, if summer hog prices were to rise back above $100 or higher, are you ok with the percentage of your production that will be capped and the opportunity cost associated with that? Everyone will have different answers to these questions, but it is a good exercise to take time considering as we begin the new year.

For more help on evaluating specific strategy alternatives or to review your operation’s risk profile, please feel free to contact us. There is a risk of loss in futures trading.

Past performance is not indicative of future results.