Much has been written about the negative outlook for the swine industry and the extremely depressed returns producers are currently experiencing. By some measures, this is the worst environment we have seen since 1998 with losses approaching $60/head and negative margins indicated through Q1 next year (Figure 1). There clearly are oversupply issues which are pressuring the pork market, but besides trying to understand why the market is so weak, many producers are also asking what they can do about it.

Figure 1. Iowa State University Historical Hog Production Returns:

Fortunately, many producers have some degree of coverage in place through year-end although likely not as much as they would desire. The increased use of government-sponsored insurance tools to manage hog revenue risk including LRP and LGM have fortunately helped by providing a floor under the market for protection taken earlier in the year when forward margins were profitable. In thinking about this existing coverage, producers should make sure that these hedges are as effective as possible to protect ongoing weakness.

While near term margins are depressed, higher hog values and cheaper feed costs being projected by the forward futures curves offer a bit more optimism for 2024. Game planning to add flexible floors under these deferred margins while allowing for upside participation should be one area of focus (Figure 2).

Figure 2. Q2 2024 Hog Margin with 20-Year Historical Range:

While the forward margin opportunity may not be as compelling as earlier in the year, an argument can still be made that it is worth protecting. Figure 3 details a comparison of the CME Cash Hog Index that the corresponding Lean Hog Futures contract settles against with current futures values for both the remainder of this year and 2024. The solid black line shows the current CME index around $80/cwt. with the nearby June futures contract trading at $77.65/cwt. That hashmark and the black line will converge in mid-June when the futures contract expires.

As you can see from the chart, the forward curve of 2024 futures values are all at or above the 10-year average of the CME Lean Hog Index which may be considered “optimistic” given the current market situation.

Figure 3. CME Cash Hog Index Versus Futures:

Much of the current weakness in the hog market can be attributed to softer demand, but recently supply has been cumbersome as well. An increase in demand may do some of the work, although lower prices are likely going to be needed at retail to move additional pork through domestic channels. There also remains concern that the U.S. economy will slip into recession later this year which is clearly a headwind for domestic demand.

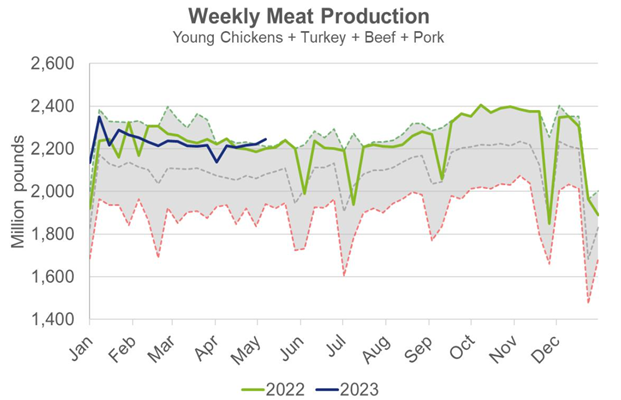

One bright spot so far this year has been export demand and we would expect this to continue as EU production continues to contract. However, domestic demand and meat production continue to offer headwinds. While we are clearly seeing lower beef production this year, the opposite has been true for poultry such that total meat supply for this time of year is sitting at a new 10-year high (Figure 4).

Figure 4. Total U.S. Meat Production Versus 10-Year Range:

Similar profit margin pressure in the poultry sector is beginning to slow production, although a further slowdown will likely be needed in both the poultry and pork sectors which could take time. Also, any move to limit supply by culling more sows historically tends to increase pressure in the short run as more pork is initially added to supply.

Any new coverage that is added for next year should be done with care to ensure that maximum flexibility is allowed to participate in higher prices. LRP and LGM are good alternatives to consider in the current environment given the cash-flow benefits and subsidies relative to exchange-traded options. Also, it might be wise to consider more coverage than would otherwise be executed under normal circumstances where an operation might incrementally chip away at opportunities as margins strengthen.

The hog market may currently be oversold with the relative strength index (RSI) sitting around 23 against spot June futures. Producers should develop a game plan for recovery that could allow for both adjustments on existing positions as well as new coverage further out on the curve to help weather the current storm.

Trading futures and options carries a risk of loss. Past performance is not indicative of future results. Insurance coverage cannot be bound or changed via phone or email. CIH is an equal opportunity employer and provider. © CIH. All rights reserved.

As we begin the new year, a lot of uncertainty remains following a tumultuous 2022, but there are reasons to be hopeful and optimistic. While spot margins are not favorable given the recent sharp selloff in hog prices combined with continued high feed costs, projected forward margins look very promising in deferred marketing periods. The current margin in Q1 2023 has deteriorated to a negative ($9.95/cwt.) which would represent the 3rd percentile of the past 10 years for any first quarter. As recently as last month, projected Q1 2023 margins were above the 80th percentile at $5.20/cwt. or higher, and there likewise was a previous opportunity to protect that level of profitability last August for this year’s first quarter. Coincidently, the projection for Q1 2024 is currently $5.27/cwt. which would be just above the 80th percentile of the past decade (Figure 1).

The contrast between this year’s Q1 and 2024 is very stark, a 10-year historical chart shows how infrequently margin values are either above or below either level (Figure 2).

Fundamentally, the picture is mixed as the pork cutout is down almost 10% from the end of last year and at its lowest value in the past 52 weeks. Weakness in bellies has been a big weight on the pork cutout as belly prices are down 35% from last year with freezer supplies swelling. The most recent USDA Cold Storage report pegged belly stocks at 63.06 million pounds at the end of December, up 15.9% from November and 65.7% above last year as well as 31.5% above the 10-year average (Figure 3).

By contrast, ham stocks are at a 10-year low of 53.4 million pounds, down 3.4% from November and 12.9% below last year as well as 22.4% below the 10-year average (Figure 4).

Export demand has been a bright spot with the year off to a solid start. For the week ending January 19 cumulative export sales reported by USDA’s FAS totaled 44,700 MT with both Mexico and China leading in volume sold. While down from the same pace a year-ago, exports are still very strong historically for the month of January, not far from a 10-year high. (Figure 5).

USDA updated pork supply and demand estimates in the January WASDE report, revising pork production higher for the first three quarters of 2023 while revising it down in Q4 relative to previous estimates. Q4 production is expected to be up almost 300 million pounds or +4.3% from last year, implying the USDA is expecting a big jump in the breeding herd as of March 1 and much higher September-November farrowings as well as a larger pig crop than the last report suggested. USDA is forecasting total pork production for 2023 at 27.495 billion pounds, up 485 million or 1.8% from last year.

There is growing optimism that the global economy may be in better shape than previously expected, particularly with China re-opening after sustained Covid-19 lockdowns. Stronger global demand and a weaker dollar which has also been a recent trend would be very helpful and welcome to sustain exports this year amidst increased production. All the same, growing production towards the end of 2023 into 2024 may threaten what are currently projected to be historically strong margins.

On the feed side, corn and soybean meal prices remain elevated as drought concerns in Argentina and strong demand from China are fundamentally supportive. While down from the past two seasons, projected Chinese corn imports of 18 MMT based on current USDA estimates would still be historically large, with an increasing share of that corn expected to come from Brazil (Figure 6).

Meanwhile, USDA trimmed their corn harvested acreage estimate in the January WASDE report to 79.2 million, the lowest since 2008-09 at 78.6 million which lowered production 200 million bushels from the previous estimate (Figure 7).

Soybean meal prices are very elevated also as strong demand and weather concerns likewise support the soybean complex. Longer-term, increased biodiesel production in the U.S. with new plants opening will divert more of the domestic crush to oil which will raise soybean meal supplies; however, this may also lead to more competition for acres which potentially could reduce the corn planting base. While the U.S. domestic crush projection for 2022-23 was left unchanged in the January WASDE report at 2.245 billion bushels, the figure would still be up almost 2% from last season to a new record high (Figure 8).

Fortunately, hog producers have a variety of ways to protect deferred margins using flexible strategies that allow for further margin improvement if hog prices move up, and/or feed costs come down. LRP might be an effective tool to protect deferred hog prices that may also have basis applications should cash prices prove particularly weak in Q4 and Q1 of 2024. Option strategies might also be employed that would likewise protect current hog values while preserving some degree of opportunity to participate in higher prices. Similar strategies can be used to protect higher potential feed costs while also maintaining the ability to realize a cost savings from lower prices over time.

Given the recent sharp deterioration in spot hog margins, producers should have added sensitivity about taking advantage of opportunities to protect favorable forward margins before they potentially deteriorate. Being proactive with risk management to secure forward profitability may prove prudent as the year unfolds in 2023. While it is impossible to know with any degree of certainty where prices are headed, it is important to realize that things often change unexpectedly, and these changes are not always favorable for margins. The past few years have presented numerous examples of how quickly things can change and disrupt profitability. The best offense is typically a good defense, and being defensive with margin opportunities is probably wise in the current environment.

Trading futures and options carries a risk of loss. Past performance is not indicative of future results. Insurance coverage cannot be bound or changed via phone or email. CIH is an equal opportunity employer and provider. © CIH. All rights reserved.

Halloween is a time of year when both kids and adults alike have fun being spooked but the hog market price action over the past month has been downright scary. December Lean Hog futures on the CME lost 18% in value over the second half of September, declining from $89 to $73/cwt. before recovering all of that lost value through October. As of this writing, the market has again turned down after facing resistance near the $90 level which has capped the contract on multiple occasions dating back to April. The feed markets by contrast have been steadier over the past couple months, although both corn and soybean meal continue to trade at historically elevated prices which has raised the cost of production and breakeven levels into 2023. From a margin standpoint, projected profitability in Q1 has seen an enormous swing with the recent hog market volatility, moving from a positive $5.00/cwt. around the 80th percentile of the past 10 years to a negative $8.50 earlier this month before recovering to back above breakeven (Figure 1).

Fundamentally, there is a lot to be optimistic about for the hog market which helps justify the recent price recovery. The September Hogs and Pigs report confirmed lower inventories including a decline in the breeding herd and forward farrowing intentions that will tighten supplies moving into next year. Moreover, producers are current as evidenced by recent trends in both slaughter weights and spot prices paid in the cash hog market. The latest Cold Storage report featured a contra-seasonal decline in pork freezer inventories, led by hams which at 159.3 million pounds were down 3% from August and 18% below last year (Figure 2).

A September drawdown in ham stocks is rare. 2019 is the only other occurrence in the past 15 years in which frozen ham inventories declined from August to September. It is interesting to note that the pork cutout contra-seasonally increased into mid-November during 2019 (Figure 3).

Turkey supplies are extremely tight this year following the Avian Influenza outbreak that hit commercial breeding flocks, and while ham prices are historically high, they remain competitive with turkey and an attractive alternative for Thanksgiving and Christmas celebrations (Figure 4). Strong export sales and shipments to Mexico are likewise supporting ham values, as the Mexican peso has not lost value to the USD despite the aggressive pace of monetary tightening by the Federal Reserve which has strengthened the dollar significantly in forex markets. Recently, exports sales have even picked up to other markets such as Japan and South Korea, two countries whose currencies have lost considerable value to the USD this year. Meanwhile, recent strength in Chinese hog prices has raised speculation that they will be more active buyers of pork on the world market ahead of the Lunar New Year, although a recent plunge in DCE hog futures prices and a significant slowdown in their economy due to the ongoing zero-Covid policy are concerning.

While overall the fundamental backdrop of the hog market is supportive as we move through Q4, one should not lose sight of the risks. The winter months historically have not been favorable for hog prices and the risk of recession here in the U.S. has risen significantly with the aggressive pace of Fed tightening. The potential impact on consumer spending should not be overlooked, and there are already indications that spending habits have changed for food consumed both at and away from home. Moreover, ASF remains a big risk factor and history has demonstrated that market reaction tends to be sharp and swift when disease issues suddenly disrupt exports.

With the recent recovery in both hog prices and forward margins, it may be prudent to look at strategies to mitigate downside risk, particularly for those who may be light on coverage in 2023. Given the potentially supportive fundamental backdrop, strategies that retain flexibility to participate in higher hog prices and improved margins may be prudent to consider. Livestock Risk Protection (LRP) insurance may be a cost-effective way to put a floor under the market while allowing for the possibility to capture any further price advances. In addition to the reduced cost and cash flow advantages with this type of coverage, there may also be basis management applications that would be advantageous for Q1.

As an alternative to LRP, option strategies may likewise make sense to retain upside price flexibility while helping to put a floor under the market and protect against negative margin outcomes. While exchange-traded alternatives may be more costly than using LRP, the expense could be reduced by accepting a cap above the market which would correspond to historically high hog prices and strong margins should the market reach that threshold. As with any strategy, it is important to strike a balance between risk and opportunity that allows your operation to manage margin volatility and achieve long-term goals. The market has provided another opportunity to help mitigate forward exposure and it may be wise to take advantage of it.

Trading futures and options carries a risk of loss. Past performance is not indicative of future results. Insurance coverage cannot be bound or changed via phone or email. CIH is an equal opportunity employer and provider. © CIH. All rights reserved.

As we work through the dog days of summer, there seems to be no shortage of optimism among many hog market participants. Much of this exuberance is rational given strong domestic demand, lower sow inventories across the U.S., EU, and China, and the expectation of stronger pork exports in the last half of the year. Cash hog prices have been advancing throughout the summer while corn and soybean complex prices have perhaps found seasonal bottoms over the past couple weeks. While these factors support hog margins, we know market dynamics can, and often do, change quickly. It is natural to focus on the bullish narrative of the market, but discipline should be exercised as we begin looking at establishing margin coverage at historically strong profitability in deferred periods.

Hog Market Considerations

The bullish case for hogs is compelling but continued headwinds on the trade front could complicate matters. Compared to last year, USDA projects U.S. pork production to fall 1.9 percent in 2022 while they peg 2023 production to increase only 1.3 percent year-over-year. Domestically, retail pork prices continue to set new record highs but remain near their long-term average as a share of retail beef prices. Of course, for a sector that exports a quarter of its production, no story on pork demand can be complete without looking at international trade. USDA projects 2022 pork exports to fall 6.4 percent from 2021. Through May (the most recent month for which complete data is available), pork exports were down 20 percent from a year earlier. Of the major trading partners, only Mexico has posted year-to-date gains from 2021.

Figure 1. U.S. Pork Exports

China’s reduction in imports from all sources has weighed on global pork trade in general and the strength of the U.S. dollar is making American product more expensive for foreign consumers. China’s slowing economy, coupled with the prospect of a recession on the horizon, could reduce international demand. USDA forecasts 2023 per capita pork consumption to be 52.4 pounds per capita. If realized, this would tie the highest level witnessed since 2000, but it is important to remember any disruption in or destruction of export demand will only exacerbate the onus put on the domestic consumer next year.

Figure 2. China Pork Exports

If the last several years have taught us anything, it is that things can change in a hurry. The CME lean hog index has been on a steady march higher since mid-May and is approaching levels last witnessed in June 2021. The PED-impacted summer of 2014 is generally held as the gold standard of the height to which hog prices can reach, but oftentimes missing from that discussion is how short-lived that price environment ended up lasting. The market scored a low in January 2014, increased through April, pulled back into June, and ran out of steam by mid-July. While the run-up in hog prices was rapid, the retreat was swift, as well. The domestic hog herd was rebuilt as producers responded to market signals. At the same time, labor disputes at West Coast ports caused major disruptions to international trade in the second half of 2014 and early 2015. One cannot help but draw a parallel between the port slowdowns from 8 years ago and the bottlenecks in supply chains we are experiencing today.

Figure 3. Historical Daily Lean Hog Index

Feedstuff considerations

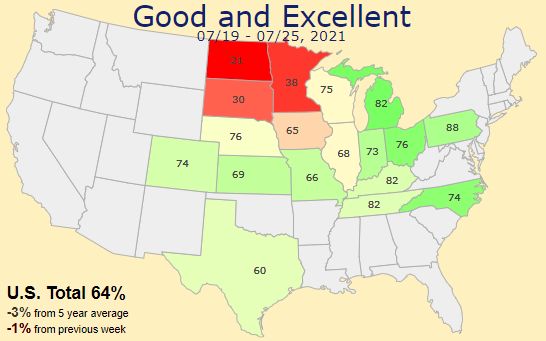

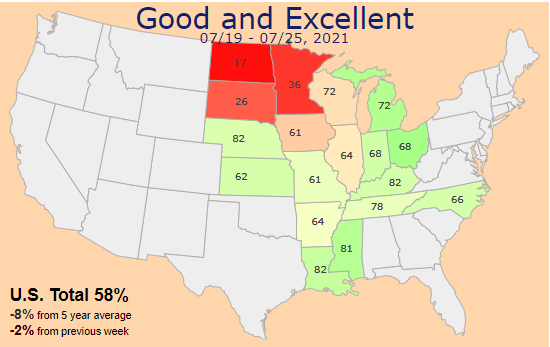

New crop futures contracts gave up Ukrainian war and weather premium over the past several weeks to return to levels last witnessed in February, offering end users a chance to protect more favorable price levels. Corn futures prices have been in reprieve since mid-June as concerns about late plantings were largely mitigated and timely rains arrived in the heart of the Corn Belt. Overall, the market fell about $2 per bushel from the mid-May high through mid-July. It is difficult to know where we go from here, but it is typical for the December contract to find a bottom in late summer. Crop condition ratings overall are slightly behind year ago levels on a national scale but remain significantly behind a year ago in the eastern Corn Belt and the High Plains.

Figure 4. Corn Conditions Map

According to CFTC data, the non-commercial long position is at a multi-year low. This all comes against the backdrop, of course, of tremendous uncertainty in the form of conflict in Ukraine, La Niña-induced dryness in South America, and expanding drought in the EU. The global corn exporter balance sheet is historically tight and there appears to be little room for yield loss this year or next, so long as product from the Black Sea cannot find its way to the world market.

Figure 5. Corn Exporter Stocks-to-Use Ratio

New crop soybean futures have followed a similar trajectory to corn. The recent pullback has uncovered demand from overseas buyers. USDA reported flash sales to China last week for the first time since June 1 and new crop soybean sales to China are at their highest level for this point in the year since 2013. Crop conditions are similar to a year ago with marked improvement across the Dakotas, but we know August weather is a vital determinant of yield potential. Weather across the central U.S. will continue to take center stage over the next few weeks. Like corn, the soybean exporter balance sheet is historically tight.

Figure 6. Soybean Exporter Stocks-to-Use

The soy complex is also in the midst of a radical change and livestock producers will likely reap the benefits. The push for renewable diesel to reduce carbon emissions has spurred a flurry of investment in crush plants across the country. The expectation is the influx of demand for soybeans and bean oil will result in increased availability of meal, driving meal costs lower. It is important to remember, however, that many of these plants are not set to come into fruition until late 2023 or 2024. While these developments could be beneficial for soybean meal buyers, it may not be fully realized for another crop year or two.

Risk Management Implications

With the geopolitics, weather, and the other market forces outlined above making headlines on a daily basis, it is easy to not see the forest for the trees. Forward profit margins on our demonstration operation have rebounded from lows scored in mid-May and are offering producers a chance to protect historically strong profitability through Q3 2023. We are near or above the 75th percentile of historical profitability over the past decade for the next 12 months.

While potential remains for margins to continue higher if the bullish fundamentals outlined above come to fruition, significant risk to the downside remains. Most producers are unwilling to completely lock in margin levels today with futures purchases and sales due to fear of missing out on higher margins. Flexible strategies can be employed to allow for margin improvement while providing protection against adverse movements in hog prices, corn and meal prices, or a combination of the three.

Figure 7. Q3 2023 Margins

Objectively assessing margin opportunities in the future is the first step to determine whether they are worth protecting. It also helps remove the constant noise in the marketplace. Discipline is at the core of every sound risk management approach. Producers have been given a chance to remove significant risk from their operations over the next year while maintaining opportunity to the upside through flexible coverage. For more help on evaluating specific strategy alternatives or to review your operation’s risk profile, please feel free to contact us.

Trading futures and options carries a risk of loss. Past performance is not indicative of future results. Insurance coverage cannot be bound or changed via phone or email. CIH is an equal opportunity employer and provider. © CIH. All rights reserved.

Hog margins have steadily improved since the beginning of the year. Futures markets are projecting the highest forward-looking hog margins for a model operation since 2014. Taking Q2 as an example, current margin projections are about $25/cwt., one of the highest projections for this quarter over the previous 10 years, and the highest for this point in the calendar year since 2014 when margins peaked at about $50/cwt. during the first week of March.

The opportunity to protect historically rare margin levels comes on the heels of a red-hot hog market, despite corn and soybean complex futures notching multi-year highs. The strength in feed markets has been quite remarkable, and it is important to realize the impact this has on profitability. Since the beginning of October, the nearly $1.00/bushel rise in corn and $100/ton increase in soybean meal have combined to reduce margins by about $8/cwt. for Q2, even though projected margins have improved almost $9/cwt. overall since then. The increase in projected hog prices has more than offset the increase in feed costs.

While you may believe the opportunity to the upside for hogs outweighs the risk to the downside, it may be prudent to protect forward profitability, particularly in deferred periods where margins could end up being weaker than current projections. Q3 2022 hog margins are currently just below $20/cwt., and like Q2, are in the top decile of the previous decade at the 93rd percentile of the past 10 years. While both Q4 and Q1 2023 margins are comparatively weaker from a historical perspective, they are nonetheless above average and close to the 80th percentile of the previous decade. Moreover, we are moving into a seasonal period where it has historically been beneficial to protect winter margins as they tend to peak during the spring.

While feed costs are already quite high, a further rise in prices could pressure forward profitability during a period when it may be more difficult for hog and pork prices to keep pace. The recent Russian invasion of Ukraine adds a whole new risk dimension to the global supply/demand outlook. The slowing of Ukrainian corn flow is a major potential issue in a tightening global balance sheet situation. Tension in the Black Sea region introduced new volatility to the market over the past several weeks.

While there are a multitude of knock-on effects from the escalation, the corn market has been particularly impacted. According to the latest WASDE report, USDA projects Ukraine to account for 17 percent of global corn exports. Ukraine on February 24 suspended commercial shipping at its ports after Russian forces invaded the country. While it is unclear the impact this will have long term on the Eastern European country’s ability to supply grain to the world, futures markets were limit up in the immediate aftermath of the invasion.

Moreover, the major corn and soybean exporter stocks to use ratios are historically low, and this magnifies the risk from uncertainty in the aftermath of Ukraine’s situation. Major corn exporter stock-to-use for the 21/22 crop year of 8.4 percent in the latest WASDE is well-below the average over the past decade. It is important to note this figure accounts for record corn production in both Argentina and Brazil, where La Nina has significantly impacted crop planting and conditions. Most analysts expect the South American crop to continue shrinking, putting further pressure on an already tighter-than-average global balance sheet.

Likewise, the global soybean balance sheet is also historically tight. USDA last projected the major soybean exporter stock-to-use ratio at 16.8 percent. If realized, this would be the lowest level since 1996. Similar to corn, USDA has been shrinking South American soybean production in each of the last two WASDE reports. Crop conditions in both Brazil and Argentina continue to struggle, opening the door for a continued tightening of the global balance sheet.

The fertilizer market is another risk factor for corn which could significantly impact the domestic supply/demand balance sheet for the upcoming crop year, particularly if the weather is unfavorable during the planting and growing season. Russia is the second largest nitrogenous fertilizer exporter to the US and nitrogenous is the second most imported type of fertilizer. Corn typically requires applications of all three nutrients (Nitrogenous, Phosphatic, Potassic), while soybeans typically only need Phosphatic and Potassic. If the Russia/Ukraine conflict leads to lower supply/higher priced Nitrogenous fertilizer, there could be more incentive to either plant soybeans over corn or use less fertilizer on the corn which would decrease yields and production.

The US imports approximately 27% of the domestic nitrogen supply, with imports sourced from Canada (19%), Russia (18%), Qatar (14%), and Trinidad and Tobago (10%). Russia recently set 6-month quotas on phosphate fertilizers, further stressing the global market. Russia accounted for 10% of global processed phosphate exports in 2020. Potassium is also important for corn growth as it aids in disease resistance and water stress tolerance. The US imports the vast majority of its potash consumption annually with imports sourced from Canada (85%), Belarus (6%) and Russia (6%).

The USDA’s Outlook Forum recently estimated 2022/23 US corn ending stocks at 1.965 billion bushels, up 425 million from this year with a stocks/use ratio at 13.2% which if realized would be the highest since the 2019/20 crop year. The projected season-ending corn price received by producers was forecast down 45 cents from the current year to $5.00/bushel. Obviously, there are a lot of assumptions in this forecast including trendline yields and normal growing conditions. The good news is that despite currently high feed prices there are margin opportunities, and it may be prudent to take advantage of these opportunities including the protection of feed input costs.

To take advantage of opportunities, it is important to know where your margins are. By taking account of your various input costs and expenses and projecting hog sales revenue against those, you can begin tracking forward profitability and put that into a historical context. This will allow you to objectively determine favorable opportunities to initiate margin protection and shield your operation from either rising feed costs or declining hog prices. While no one can know for certain what the markets will do as we move forward in time, it is probably safe to say that we can expect more volatility given increased uncertainties.

Trading futures and options carries a risk of loss. Past performance is not indicative of future results. Insurance coverage cannot be bound or changed via phone or email. CIH is an equal opportunity employer and provider. © CIH. All rights reserved.

The outlook for forward hog margins is less optimistic than it was even a month ago following the release of the USDA’s September Hogs & Pigs report. The surprising data indicating there were fewer pigs than what the market anticipated produced a bullish response in the futures market, although that soon faded as the calendar turned over to October. Spot December Lean Hog futures subsequently dropped about $13/cwt., and despite a recent bounce remain below the level we were trading prior to that quarterly report. Factors including a concern over labor shortages that could impact processor capacity in the winter months when it is needed the most as well as a significant slowdown in pork export sales to China recently have in part been attributed to the recent slump.

Meanwhile, feed costs have crept higher despite what generally have been better than expected yield results for both corn and soybeans as harvest winds down. Strong corn demand from the ethanol sector as margins swell to multi-year highs have supported the spot market, while concerns over South American weather and high fertilizer prices potentially reducing corn acreage in the U.S. next spring are adding premium further out on the curve. As a result of pressure from both lower hog prices and higher projected feed costs recently, forward margins have deteriorated over the past month and are only about average from a historical perspective looking back over the past 10 years. (Figure 1)

Figure 1 – Hog Margins (Q4 2021 – Q3 2022)

Focusing on either the spot Q4 or upcoming Q1 marketing periods, where margins are currently negative, there have been ample opportunities over the past several months to protect historically strong profitability and well above average margins. In fact, Q4 margins briefly breeched the 90th percentile of the past decade following the September Hogs and Pigs report, with projected profitability at $7.89/cwt. on September 30th (Figure 2). This followed a series of opportunities to protect at least 80th percentile margins going back to the middle of May. While it is obviously too late to do anything about protecting Q4 margins now that the marketing period is almost half over, there may be upcoming opportunities to address risk further out in 2022 if the margin landscape improves.

Figure 2 – Q4 2021 Hog Margin

In order to take advantage of these opportunities however, it is important to know where your margins are at. By taking account of your various input costs and expenses, and projecting hog sales revenue against those, you can begin tracking forward profitability and put that into a historical context. This will allow you to objectively determine favorable opportunities to initiate margin protection and shield your operation from either rising feed costs or declining hog prices.

While no one can know for certain what the markets will do as we move forward in time, it is probably safe to say that we can expect more volatility given increased uncertainties. Will China begin to see sow liquidation due to depressed prices and negative margins? Are there going to be less corn acres next spring because of high input costs? Is South America going to have a drought during their growing season? If strong demand continues from the ethanol sector, is it possible that the balance sheet may end up being much tighter than what the market expects?

Looking again at the graph of Q4 hog margins in Figure 2, you will notice that there has been quite a bit of volatility over the past six months. Margins have ranged from over $7.50/cwt. positive to about $5/cwt. negative since the middle of April. Swings in both hog prices and feed input costs have led to these changes in projected profitability, and this volatility creates opportunities. In addition to signaling beneficial times to initiate margin coverage, these price swings also allow for opportunities to improve existing margin protection. Examples of this include reducing cost in hedging strategies, creating more price flexibility in hedge positions, cutting exposure to performance bonds, and taking equity out of positions.

Moreover, with recent improvements to the LRP program and new alternatives like the CME’s pork cutout contract, there are now a variety of ways that margin protection can be established and more opportunities to create complimentary or supplemental positions once this protection is put in place. Regardless of the tools used, the main point is to have a plan and be disciplined with following through on that plan. Does your operation have triggers in place to establish coverage in forward time periods? Do you anticipate what types of supplemental strategies might allow you to improve on that coverage over time?

Figure 3 – Q4 Hog Margin 10-Year Seasonal

Figure 3 displays the seasonal tendency for Q4 margins over the past 10 years. The recent spike in margins to above the 90th percentile corresponds to a typical period of strength where margins seasonally peak at the 85th percentile by the first week of October. A secondary period of strength typically occurs from mid-January to mid-April (highlighted by the green bars), suggesting that producers be ready to execute on possible opportunities that may show up into that period. Similar approaches could be taken for other periods such as Q2 and Q3 2022.

Inventorying your costs and revenues to project forward margins and putting a plan together that will allow your operation to take advantage of opportunities once they arise can put your operation in a better position to be competitive. Now more than ever, it is important to be proactive in managing forward profitability. Please feel free to contact us with questions on how to create a margin management plan and take change of your bottom line.

Trading futures and options carries a risk of loss. Past performance is not indicative of future results. Insurance coverage cannot be bound or changed via phone or email. CIH is an equal opportunity employer. © CIH. All rights reserved.

In today’s fast-paced world where everyone is connected to the 24-hour news cycle, it can be difficult to tune out noise and opinions. The constant influx of COVID-19 headlines, weather maps for crop production regions, estimates of yield potential, and animal health issues have dominated agricultural news outlets. While it is natural to focus on how each of these factors could impact lean hog, corn, and soybean meal prices, it is also important to put those factors into greater context. Using futures markets to project forward margin curves for hog producers, the market is offering favorable pricing opportunities throughout the rest of the year and the first half of 2022. These margins are offered despite a tremendous amount of uncertainty heading into the same timeframe.

Leaning on lessons learned when favorable margin opportunities eroded after the initial reaction to PED and ASF, solid margin opportunities are not static and can be fleeting. For that reason, it often makes sense to begin thinking about layering into coverage when profitability can be secured, as it can be today. Despite the rapid rise in corn and soybean meal prices since the beginning of the year and the quicker-than-expected rebound in Chinese pork production, open market margins in Q4 2021 are at their highest level for this point in the year since 2014. Notwithstanding the unknowns in the marketplace, some of which are outlined below, securing historically strong profit opportunities may be an attractive option for producers today and should be considered.

No Shortage of Unknowns

As we head into the end of summer, market participants’ focus continues to zero in on new crop corn and soybean supplies. While volatility in the corn and soybean markets has tapered in recent weeks, crop condition ratings remain toward the lower end of the historical range because of widespread hot and dry weather throughout the upper Midwest. Even though we are already in August, industry opinions on final yield projections still vary greatly, placing additional emphasis on the upcoming August 12th WASDE report. In light of the continued importance of domestic weather and recent global production challenges, market volatility seems likely to persist. Uncertainties within feed markets can be managed in conjunction lean hogs to protect solid margin opportunities.

Figure 1. Corn Crop Progress

Figure 2. Soybean Crop Progress

Robust domestic demand and strong export shipments throughout the first half of this year have continued to support hog prices. Lower production, strong grocery sales, and lower weights have underpinned a hog market that made a remarkable rebound from the lows seen in the first half of 2020. While high feed prices will likely curtail expansion in the near term, there are also some uncertainties which could derail an otherwise optimistic outlook. Global swine health is always an important variable in margin outlooks and has dominated headlines in recent weeks. A common theme at recent industry events has been the impact PRRS continues to have on the domestic hog herd. On July 19, Germany confirmed its first case of African swine fever (ASF) in a domestic swine herd after more than 1,200 cases in wild boars in the eastern region of the country. On July 28, the USDA confirmed ASF in samples from pigs in the Dominican Republic, marking the first detection of the disease in the Western Hemisphere in about 40 years offering another reminder that ASF continues its march around the globe and the pork industry remains a single event away from a market-altering headline.

China was a major driver of pork export growth over the last two years but shipments and sales of pork exports to China have slowed in recent weeks. Widespread floods across China’s Henan province present another hurdle in its herd rebuilding efforts. After the province’s worst flash floods in centuries, reports of widespread crop and infrastructure losses were prevalent. More than a million livestock are reported to have died across nearly 1,700 farms, causing concern about the potential for disease to spread. Henan was the country’s second largest grain producer and the third largest pig producer in 2020.

Figure 3. Pork Export Commitments to China

Supply chain issues throughout the economy have been well-documented since the beginning of the pandemic and the hog sector has not been immune. The recent federal court ruling to repeal the provision of the New Swine Slaughter Inspection System (NSIS) that enabled pork processors to safely increase maximum line speeds adds to the uncertainty for this coming fall and winter. Combined with questions surrounding California’s Proposition 12 and its potential impact on demand as well as the recent resurgence of COVID, there are many factors that could impact future margins – both good and bad. When you consider that August 2020 hog futures traded as low as $47 and August 2021 futures traded as high as $120, protecting strong margins seems to be a prudent idea.

Current Opportunities and Structuring Your Coverage

Open market margins for Q4 2021 are at the 87th percentile of profitability over the past 10 years, offering producers a chance to protect historically strong profitability. Likewise, open market margin levels in Q1 and Q2 2022 are at the 83rd and 74th percentiles, respectively. Projected Q4 2021 margins for a demonstration operation can be seen below.

Figure 4. Q4 Open Market Margin

There are many different strategies that one may consider to protect the opportunities the market is offering today. Each strategy differs in its level of margin protection to the downside, opportunity to the upside, and cash flow considerations. A producers’ position should also reflect his or her individual bias. Given the risk and uncertainty on both the input and revenue side of the margin equation, it likely makes sense to protect both components in some way, shape, or form. Futures, options, and the recently-revamped Livestock Risk Protection (LRP) program may by viable tools to fit into your margin management approach.

Protecting favorable margin levels does not necessarily mean one must “lock in” each component with futures. For example, if a farmer is bullish on hogs, a flexible strategy could be developed to allow for an improvement in lean hog futures between today and the Q4 2021. Allowing for $10 of upside would increase the open market margin to the 95th percentile. Likewise, a producer may be bearish corn and believe there is a chance December corn futures could be trading down at $5.00 per bushel by the end of the year. Allowing for 50 cents to the downside from today’s price level would increase the open market margin to the 90th percentile of historical profitability.

With all the risks inherent in the management of forward hog margins, it is important to remain disciplined. With positive margins that are historically strong, it may make sense to examine a mix of futures, options, physical, and/or LRP to protect these margin levels. Opportunities and risks abound heading into the end of the year, from crop size to unknown exports and domestic demand. Whether focusing on margins through Q4 2021 or beginning to scale into coverage throughout the first half of 2022, a variety of different strategies can address the tradeoff between trying to preserve forward opportunity and protect existing profitability. For more help on evaluating specific strategy alternatives or to review your operation’s risk profile, please feel free to contact us.

Trading futures and options carries a risk of loss. Past performance is not indicative of future results. Insurance coverage cannot be bound or changed via phone or email. CIH is an equal opportunity employer and provider. © CIH 2021. All rights reserved.