Dairy producers face a unique challenge in margin management that their counterparts in the swine and beef cattle industries do not share. Unlike cattle and hogs where there is only one futures contract that serves as a benchmark of value for forward revenue projections, dairy producers have multiple contracts including Class III and Class IV Milk, cheese, butter, powder, whey and nonfat dry milk. As a result, understanding how to project forward prices using the futures market as a price discovery mechanism, and further how to protect those prices using those contracts’ risk transfer functions becomes more confusing for a dairy. In order to make sense of this, it is important for dairy producers to understand how they are paid for their milk. From there, the relationship between the cash price dairies receive for their milk and futures prices that serve as a benchmark for this value in a forward time period can help producers get a better handle on how to manage their milk revenue in a comprehensive margin plan.

First, all dairy producers receive what is known as a “Uniform Blend Price” for the milk that they market commercially to their coops and creameries. The Uniform Blend Price essentially represents a pooled value for milk based on the utilizations for that milk in each part of the country where it is marketed. Raw fluid milk is processed and utilized in a variety of dairy products which varies from one area to another. As a result, the value of the milk pool likewise varies from region to region as milk is processed for different purposes in different areas.

There are four classifications of milk with the following distinctions:

- Class I – milk utilized for fluid consumption

- Class II – milk utilized for soft manufactured products (cottage cheese, yogurt, etc.)

- Class III – milk utilized for cheese and whey

- Class IV – milk utilized for butter and powder

Regardless of the particular area or region of the country, milk is utilized in all classes every month, and the milk payments received by producers reflect the value of milk across these various classes. Because some classes have higher utilizations than others depending on the particular marketing order, producers receive different values for their milk.

While there are several dairy futures contracts that trade on the CME, Class III Milk is widely regarded as the benchmark value for milk across the country. This in part stems from the fact that the liquidity is highest for this particular contract and it is the most widely used among market participants, even beyond the hedging realm. Although most dairy producers reference the Class III price as a benchmark for the value of their milk, the reality is that their milk check is not based solely on this Class III value as the uniform blend price represents the utilizations for all classes of milk in their pool. In the component pricing orders (Northeast, Upper Midwest, Central, Mideast, Pacific Northwest, and Southwest) this creates what is known as the Producer Price Differential or PPD.

A simple way to think of PPD is that it represents the remaining value in the pool after paying the producer Class III. Dairy producers are paid only the Class III price (protein, butterfat, other solids) for the milk they market regardless of what the milk was used to produce. In that way, the producer may not receive the value of higher-priced classes nor lower priced classes. The Producer Price Differential is meant to shore up the difference between Class III payment and the remaining value in the pool. This could result in a negative value if Class III payments are in excess of the total pool value (a negative PPD).

Understanding the Producer Price Differential

This differential fluctuates from month to month as a function of the value of Class III relative to the other milk classes. Producer price differential is calculated as follows:

- The Marketing Order compiles all uses for the milk delivered in pounds and multiplies by the monthly price for that product to sum the Total Producer Milk Value

- Because producers are paid Class III components, the Marketing Order takes all pounds of protein, butterfat and other solids (regardless of what class it was used for) and multiplies by the corresponding price for each component to arrive at an Only Class III Value for all milk

- PPD is the difference between Total Producer Milk Value and the Only Class III Value

Uniform Blend Price versus Class III Futures

While using the Class III futures contract can serve as a benchmark of value for a producer’s milk in a forward time period, Class III prices do not explain all of the variance in milk revenue values. In other words, there is not a perfect correlation between Class III futures and uniform blend prices. This can be seen by measuring the historical correlation between Class III milk and uniform blend prices. Correlations between Class III futures and uniform blend prices will be stronger for marketing orders that utilize a large percentage of the milk to create Class III products and will be weaker for areas that utilize a smaller percentage of the milk to create Class III products. This makes sense as a Federal Order that utilizes milk only for Class III will not have any impact or variance for the value of milk from other classes.

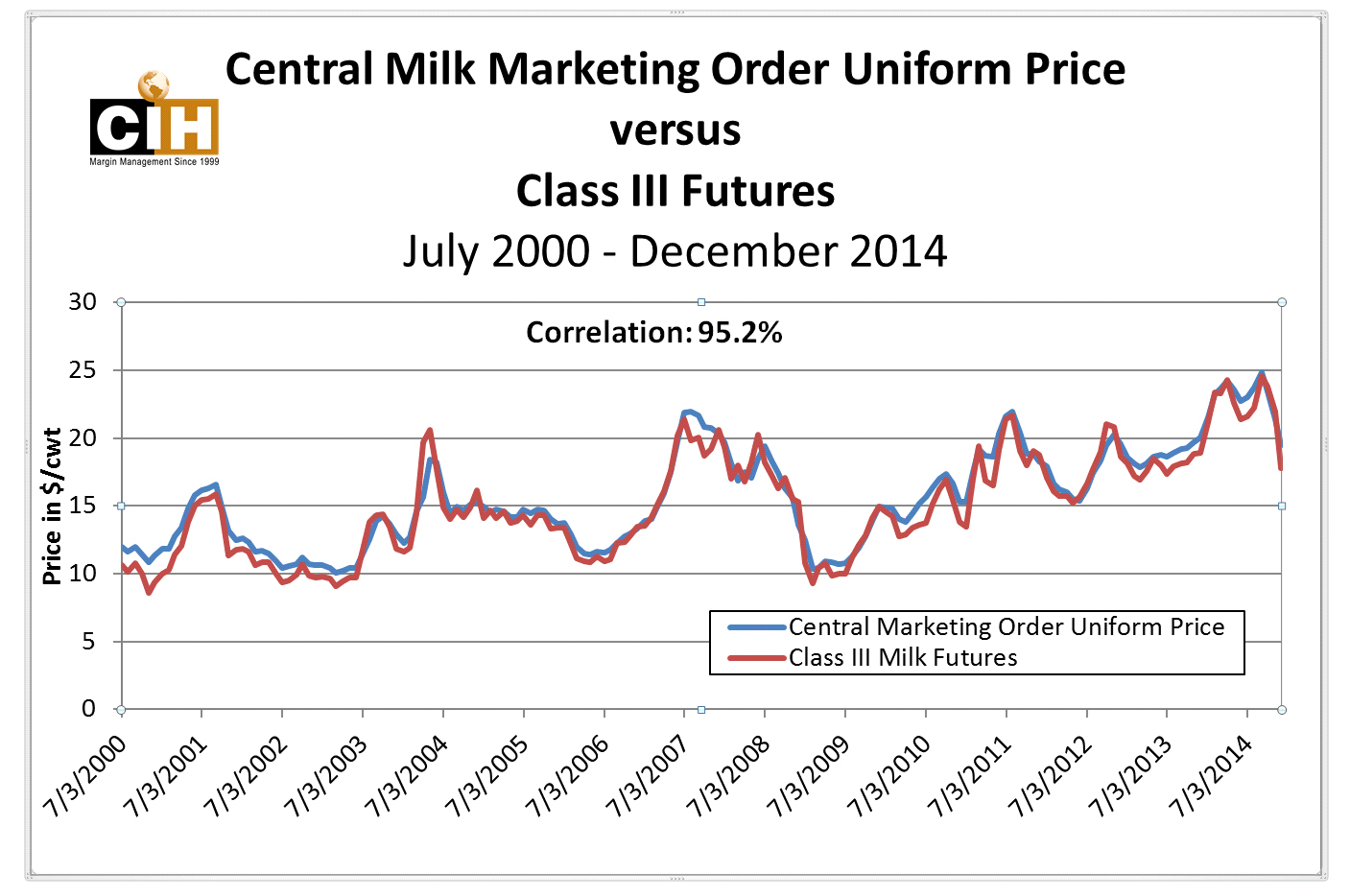

For example, the Upper Midwest Milk Marketing Order has historically utilized between 78 and 82% of the milk delivered to produce Class III products every month of the year. As a result, the Upper Midwest uniform blend price correlates at 98% with Class III futures. By contrast, the Florida Milk Marketing Order has historically utilized between 82 and 86% of the milk delivered to produce Class I products every month of the year. The Florida uniform blend price correlates at 87% with Class III futures. Correlations similarly vary across other Federal Orders as a function of how much milk is utilized for Class III versus the other classes of milk. Each marketing order will have a different correlation between the uniform blend price and Class III futures. Below is a chart showing the correlation between the Central Milk Marketing Order and Class III futures:

Getting back to the futures market and the various dairy contracts available to use as a hedge against their future milk check, there is both a Class III and a Class IV milk contract. When analyzing what goes into the pricing for each of the four milk classes, it is interesting to note that all of them relate to Class III or Class IV in some way. Because of this, the uniform blend price that a producer receives for their milk will be influenced by both the Class III and the Class IV price. A look at the determinants of price for each class of milk can show the impact of Class IV on the uniform blend price:

- Class I price = Higher of Advanced Class III skim price or Advanced Class IV skim price

- Class II price = Advanced Class IV plus $0.70

- Class III price = Butterfat, Protein, Other Solids (No effect from Class IV)

- Class IV price = Nonfat Solids price * 9

The Class II, III and IV price equations are fairly straightforward with Class II being a function of the Class IV pricing formula. Class I prices can be a function of either the Class III or the Class IV price, depending on which one is higher. The effect Class IV ultimately has on the uniform blend price will therefore be a function of the utilization for each class of milk in the particular marketing order, but this should be fairly similar from month to month.

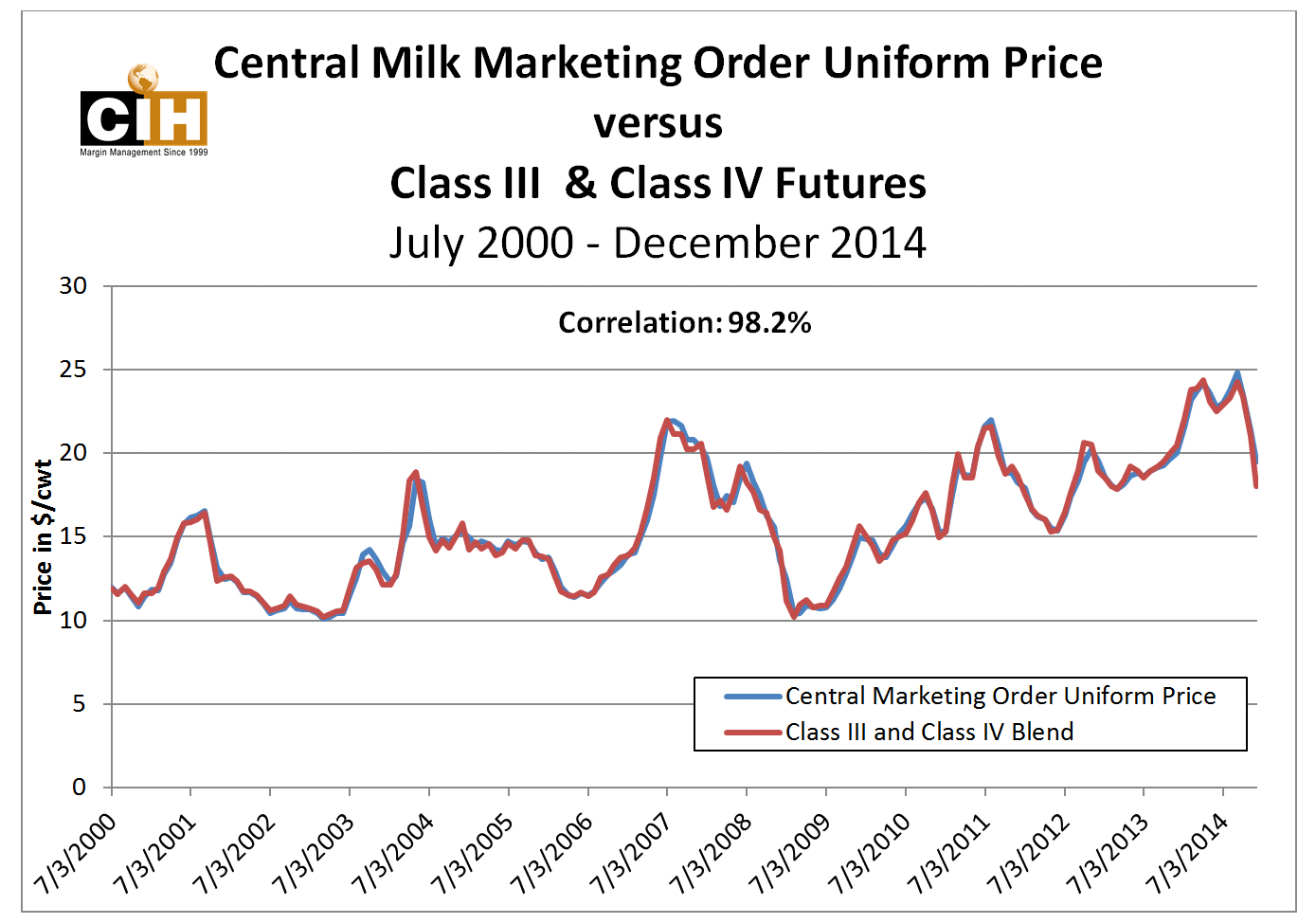

What this suggests is that a dairy producer needs to look at both the Class III and the Class IV price of milk together as opposed to just Class III alone to represent a benchmark of value for their milk in a forward time period. The exact ratio between the two will depend on what particular marketing order a producer is located in. By analyzing price history, we can determine how much of an effect the Class III price and the Class IV price have historically had on the uniform blend price for any particular order. Furthermore, it is possible to combine a ratio of Class III and Class IV futures prices whereby the combination explains more of the historical variance in the uniform blend price for any particular order. In other words, the correlation between the ratio of Class III and Class IV (the combination of the two) and the uniform blend price improves from just using the Class III price alone for all orders. Below is a chart showing the correlation between the Central Milk Marketing Order and a combination of Class III and Class IV futures:

The benefit of this is that by combining both contracts to improve the correlation between cash and futures (the historical variance between the uniform blend price and the milk futures price), much of the monthly fluctuations in PPD can be addressed and a more accurate hedge created to protect the value of a producer’s milk in a forward time period. By only using the Class III contract to hedge milk, PPD will always be a risk factor to deal with and this risk will be greater for producers who sell their milk in marketing orders where the Class III utilization is lower. To learn more about how your uniform blend price has historically varied between Class III and Class IV futures, please contact us to conduct a more detailed analysis.