In today’s fast-paced world where everyone is connected to the 24-hour news cycle, it can be difficult to tune out noise and opinions. The constant influx of COVID-19 headlines, weather maps for crop production regions, estimates of yield potential, and animal health issues have dominated agricultural news outlets. While it is natural to focus on how each of these factors could impact lean hog, corn, and soybean meal prices, it is also important to put those factors into greater context. Using futures markets to project forward margin curves for hog producers, the market is offering favorable pricing opportunities throughout the rest of the year and the first half of 2022. These margins are offered despite a tremendous amount of uncertainty heading into the same timeframe.

Leaning on lessons learned when favorable margin opportunities eroded after the initial reaction to PED and ASF, solid margin opportunities are not static and can be fleeting. For that reason, it often makes sense to begin thinking about layering into coverage when profitability can be secured, as it can be today. Despite the rapid rise in corn and soybean meal prices since the beginning of the year and the quicker-than-expected rebound in Chinese pork production, open market margins in Q4 2021 are at their highest level for this point in the year since 2014. Notwithstanding the unknowns in the marketplace, some of which are outlined below, securing historically strong profit opportunities may be an attractive option for producers today and should be considered.

No Shortage of Unknowns

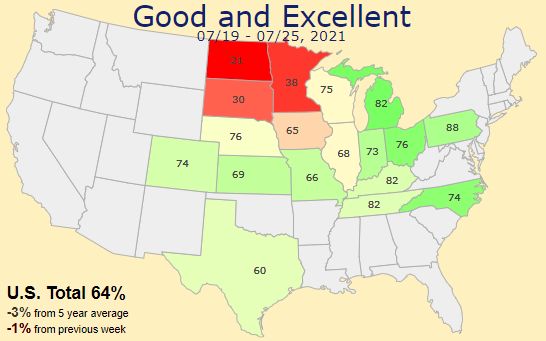

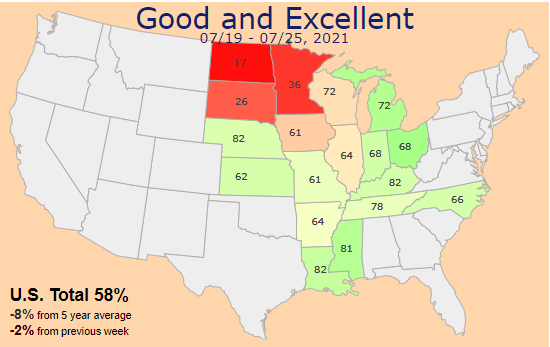

As we head into the end of summer, market participants’ focus continues to zero in on new crop corn and soybean supplies. While volatility in the corn and soybean markets has tapered in recent weeks, crop condition ratings remain toward the lower end of the historical range because of widespread hot and dry weather throughout the upper Midwest. Even though we are already in August, industry opinions on final yield projections still vary greatly, placing additional emphasis on the upcoming August 12th WASDE report. In light of the continued importance of domestic weather and recent global production challenges, market volatility seems likely to persist. Uncertainties within feed markets can be managed in conjunction lean hogs to protect solid margin opportunities.

Figure 1. Corn Crop Progress

Figure 2. Soybean Crop Progress

Robust domestic demand and strong export shipments throughout the first half of this year have continued to support hog prices. Lower production, strong grocery sales, and lower weights have underpinned a hog market that made a remarkable rebound from the lows seen in the first half of 2020. While high feed prices will likely curtail expansion in the near term, there are also some uncertainties which could derail an otherwise optimistic outlook. Global swine health is always an important variable in margin outlooks and has dominated headlines in recent weeks. A common theme at recent industry events has been the impact PRRS continues to have on the domestic hog herd. On July 19, Germany confirmed its first case of African swine fever (ASF) in a domestic swine herd after more than 1,200 cases in wild boars in the eastern region of the country. On July 28, the USDA confirmed ASF in samples from pigs in the Dominican Republic, marking the first detection of the disease in the Western Hemisphere in about 40 years offering another reminder that ASF continues its march around the globe and the pork industry remains a single event away from a market-altering headline.

China was a major driver of pork export growth over the last two years but shipments and sales of pork exports to China have slowed in recent weeks. Widespread floods across China’s Henan province present another hurdle in its herd rebuilding efforts. After the province’s worst flash floods in centuries, reports of widespread crop and infrastructure losses were prevalent. More than a million livestock are reported to have died across nearly 1,700 farms, causing concern about the potential for disease to spread. Henan was the country’s second largest grain producer and the third largest pig producer in 2020.

Figure 3. Pork Export Commitments to China

Supply chain issues throughout the economy have been well-documented since the beginning of the pandemic and the hog sector has not been immune. The recent federal court ruling to repeal the provision of the New Swine Slaughter Inspection System (NSIS) that enabled pork processors to safely increase maximum line speeds adds to the uncertainty for this coming fall and winter. Combined with questions surrounding California’s Proposition 12 and its potential impact on demand as well as the recent resurgence of COVID, there are many factors that could impact future margins – both good and bad. When you consider that August 2020 hog futures traded as low as $47 and August 2021 futures traded as high as $120, protecting strong margins seems to be a prudent idea.

Current Opportunities and Structuring Your Coverage

Open market margins for Q4 2021 are at the 87th percentile of profitability over the past 10 years, offering producers a chance to protect historically strong profitability. Likewise, open market margin levels in Q1 and Q2 2022 are at the 83rd and 74th percentiles, respectively. Projected Q4 2021 margins for a demonstration operation can be seen below.

Figure 4. Q4 Open Market Margin

There are many different strategies that one may consider to protect the opportunities the market is offering today. Each strategy differs in its level of margin protection to the downside, opportunity to the upside, and cash flow considerations. A producers’ position should also reflect his or her individual bias. Given the risk and uncertainty on both the input and revenue side of the margin equation, it likely makes sense to protect both components in some way, shape, or form. Futures, options, and the recently-revamped Livestock Risk Protection (LRP) program may by viable tools to fit into your margin management approach.

Protecting favorable margin levels does not necessarily mean one must “lock in” each component with futures. For example, if a farmer is bullish on hogs, a flexible strategy could be developed to allow for an improvement in lean hog futures between today and the Q4 2021. Allowing for $10 of upside would increase the open market margin to the 95th percentile. Likewise, a producer may be bearish corn and believe there is a chance December corn futures could be trading down at $5.00 per bushel by the end of the year. Allowing for 50 cents to the downside from today’s price level would increase the open market margin to the 90th percentile of historical profitability.

With all the risks inherent in the management of forward hog margins, it is important to remain disciplined. With positive margins that are historically strong, it may make sense to examine a mix of futures, options, physical, and/or LRP to protect these margin levels. Opportunities and risks abound heading into the end of the year, from crop size to unknown exports and domestic demand. Whether focusing on margins through Q4 2021 or beginning to scale into coverage throughout the first half of 2022, a variety of different strategies can address the tradeoff between trying to preserve forward opportunity and protect existing profitability. For more help on evaluating specific strategy alternatives or to review your operation’s risk profile, please feel free to contact us.

Trading futures and options carries a risk of loss. Past performance is not indicative of future results. Insurance coverage cannot be bound or changed via phone or email. CIH is an equal opportunity employer and provider. © CIH 2021. All rights reserved.