Much has been written about the negative outlook for the swine industry and the extremely depressed returns producers are currently experiencing. By some measures, this is the worst environment we have seen since 1998 with losses approaching $60/head and negative margins indicated through Q1 next year (Figure 1). There clearly are oversupply issues which are pressuring the pork market, but besides trying to understand why the market is so weak, many producers are also asking what they can do about it.

Figure 1. Iowa State University Historical Hog Production Returns:

Fortunately, many producers have some degree of coverage in place through year-end although likely not as much as they would desire. The increased use of government-sponsored insurance tools to manage hog revenue risk including LRP and LGM have fortunately helped by providing a floor under the market for protection taken earlier in the year when forward margins were profitable. In thinking about this existing coverage, producers should make sure that these hedges are as effective as possible to protect ongoing weakness.

While near term margins are depressed, higher hog values and cheaper feed costs being projected by the forward futures curves offer a bit more optimism for 2024. Game planning to add flexible floors under these deferred margins while allowing for upside participation should be one area of focus (Figure 2).

Figure 2. Q2 2024 Hog Margin with 20-Year Historical Range:

While the forward margin opportunity may not be as compelling as earlier in the year, an argument can still be made that it is worth protecting. Figure 3 details a comparison of the CME Cash Hog Index that the corresponding Lean Hog Futures contract settles against with current futures values for both the remainder of this year and 2024. The solid black line shows the current CME index around $80/cwt. with the nearby June futures contract trading at $77.65/cwt. That hashmark and the black line will converge in mid-June when the futures contract expires.

As you can see from the chart, the forward curve of 2024 futures values are all at or above the 10-year average of the CME Lean Hog Index which may be considered “optimistic” given the current market situation.

Figure 3. CME Cash Hog Index Versus Futures:

Much of the current weakness in the hog market can be attributed to softer demand, but recently supply has been cumbersome as well. An increase in demand may do some of the work, although lower prices are likely going to be needed at retail to move additional pork through domestic channels. There also remains concern that the U.S. economy will slip into recession later this year which is clearly a headwind for domestic demand.

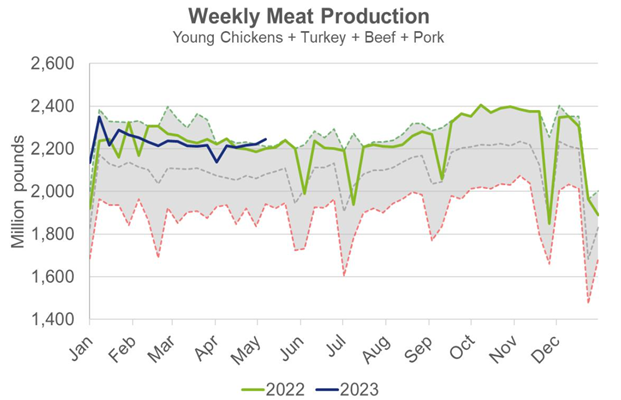

One bright spot so far this year has been export demand and we would expect this to continue as EU production continues to contract. However, domestic demand and meat production continue to offer headwinds. While we are clearly seeing lower beef production this year, the opposite has been true for poultry such that total meat supply for this time of year is sitting at a new 10-year high (Figure 4).

Figure 4. Total U.S. Meat Production Versus 10-Year Range:

Similar profit margin pressure in the poultry sector is beginning to slow production, although a further slowdown will likely be needed in both the poultry and pork sectors which could take time. Also, any move to limit supply by culling more sows historically tends to increase pressure in the short run as more pork is initially added to supply.

Any new coverage that is added for next year should be done with care to ensure that maximum flexibility is allowed to participate in higher prices. LRP and LGM are good alternatives to consider in the current environment given the cash-flow benefits and subsidies relative to exchange-traded options. Also, it might be wise to consider more coverage than would otherwise be executed under normal circumstances where an operation might incrementally chip away at opportunities as margins strengthen.

The hog market may currently be oversold with the relative strength index (RSI) sitting around 23 against spot June futures. Producers should develop a game plan for recovery that could allow for both adjustments on existing positions as well as new coverage further out on the curve to help weather the current storm.

Trading futures and options carries a risk of loss. Past performance is not indicative of future results. Insurance coverage cannot be bound or changed via phone or email. CIH is an equal opportunity employer and provider. © CIH. All rights reserved.